Time horizon simply suggests once you want the money. Do you need the money tomorrow or in 30 a long time? Are you presently preserving to get a residence deposit in a few yrs or are you presently looking to make use of your money in retirement? Time horizon determines what forms of investments tend to be more proper.

that we get yourself a mega-return on. From USA TODAY But the vast majority of what we are seeing just demonstrates a perceived lack of great investment

Venture capitalists receive a stake in the company in return for his or her investment. That may or may not pay back at some point.

Overview: A high-yield online savings account pays you interest with your dollars equilibrium. And similar to a savings account at your brick-and-mortar bank, high-generate online savings accounts are obtainable automobiles on your income.

Free dollars flow measures the dollars a company generates which is out there to its debt and fairness investors, after allowing for reinvestment in Functioning capital and money expenditure. High and rising no cost cash circulation, for that reason, tend to make an organization additional eye-catching to investors.

Undertaking capitalists often take on advisory222222 roles and sit within the board of administrators for the business.

Presently, she will be the senior investing editor at Bankrate, foremost the group’s coverage of all items investments and retirement. Previous to this, Mercedes served for a senior editor at NextAdvisor.

Our investing reporters and editors deal with the factors customers treatment about most — ways to get rolling, the best brokers, forms of investment accounts, how to settle on investments plus more — so you can feel self-assured when investing your money.

Celebrity-luring Tribeca lofts with ‘paparazzi-proof’ garage mired in $376M complaint: ‘Basically falling aside’

Other exit techniques are a lot less appealing for the undertaking capitalist given that they're not as rewarding. They incorporate a takeover on the startup by An additional business see this website or its remaining a profitable but privately-held business enterprise.

However, you remove many of those risks by purchasing a dividend stock fund with a diversified assortment of assets, lowering your reliance on any single enterprise.

Mergers and IPOs have plunged considering the fact that 2021. What this means is private equity hasn’t been able to exit a lot of in their investments, so they’re not returning cash for their investors, or limited partners. The LPs aren’t finding their money again, so that they don’t possess the funds to allocate to new funds, earning fundraising Significantly more challenging. Some general public PE firms, like Blackstone and Carlyle Group, reported a double digit drop in distributable earnings, which refers back to the level of cash accessible to return to investors, last 12 months. From 2000 to 2022 non-public equity distributions averaged around 24% on the prior yr’s NAV, The online value of the investment fund's property, In keeping with Ian Aaker, a companion at StepStone Group, an investment and advisory firm. This dropped to 10% in 2023, he reported.

Pamela de la Fuente may be the assigning editor on NerdWallet's taxes vertical. Her workforce addresses tax brackets and rates, income tax filing and tax-advantaged retirement accounts, amongst other matters. She continues to be a writer and editor for more than 20 years.

The Founder's Role Numerous angel investors and VC investors point out that the personality and generate of the organization founders are as essential or even more vital than the enterprise concept itself.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Daryl Hannah Then & Now!

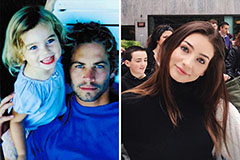

Daryl Hannah Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!